Introduction of invoice system under the Consumption Tax Law

- 2023.09.20

- Domestic tax

- Non-residents of Japan, Qualified invoices Description, qualified invoicing business, Special exception for obtaining a registration number

1. Introduction of the invoice system = Becoming a qualified invoicing business

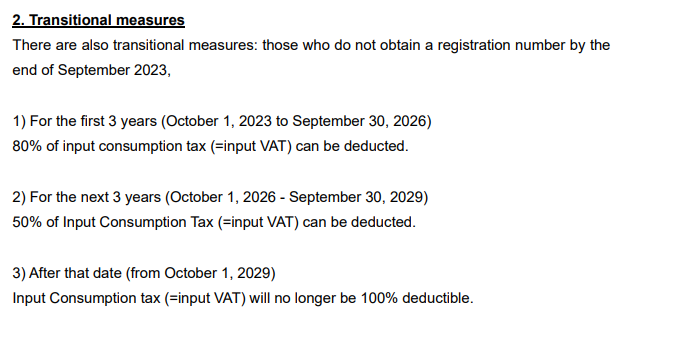

The invoice system will be introduced in the Consumption Tax Law (=VAT Law) from October 2023. The consumption tax rate in Japan is 10%. A reduced consumption tax rate of 8% will be applied to “food and beverages excluding alcoholic beverages and restaurant food” and “newspapers published more than twice a week with a subscription agreement.

In principle, a person who wishes to receive a refund of input consumption tax (=input VAT) on a transaction must obtain a registration number from the tax office by the end of September 2023. Registered businesses are entitled to input consumption tax (=input VAT) refunds, but must also file output consumption tax (=output VAT) returns on a regular basis.

2. Transitional measures

There are also transitional measures: those who do not obtain a registration number by the end of September 2023,

1) For the first 3 years (October 1, 2023 to September 30, 2026)

80% of input consumption tax (=input VAT) can be deducted.

2) For the next 3 years (October 1, 2026 – September 30, 2029)

50% of Input Consumption Tax (=input VAT) can be deducted.

3) After that date (from October 1, 2029)

Input Consumption tax (=input VAT) will no longer be 100% deductible.

3. Special exception for obtaining a registration number

If you wish to become a Qualified Invoicing Business starting in February 2024, you must apply for registration by December 31 (you must apply for registration no later than “one month before” the first day of the taxable period).

4. Imports to Japan

At the time of first importation, the import permit will be substituted on the invoice.

5. Foreign operators

1) If you are already a consumption taxable business in Japan

By the end of September 2023, obtain a registration number from the tax office and issue an invoice in accordance with the instructions for a qualified invoice as explained later. → see [6] below.

2) Non-residents of Japan who intervene in transactions in Japan

Designate a Japanese resident as a tax representative, obtain a registration number from the tax office by the end of September 2023, and issue an invoice in accordance with the instructions for a qualified invoice as explained below.

Registered businesses will file consumption tax returns through the tax representative.

Input consumption tax (=input VAT) will be refunded, but at the same time, output consumption tax (=output VAT) must be declared periodically.

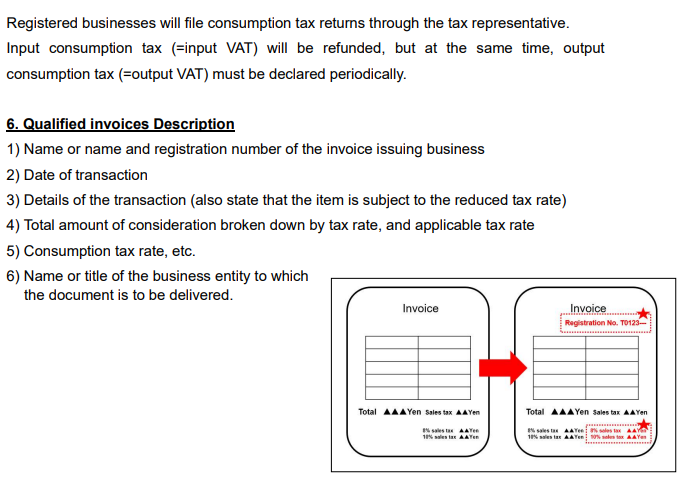

6. Qualified invoices Description

1) Name or name and registration number of the invoice issuing business

2) Date of transaction

3) Details of the transaction (also state that the item is subject to the reduced tax rate)

4) Total amount of consideration broken down by tax rate, and applicable tax rate

5) Consumption tax rate, etc.

6) Name or title of the business entity to which the document is to be delivered.

If you have any questions or would like to discuss your concerns, please feel free to contact us here.⇒

-

前の記事

Introduction of the invoice system: part 2 2023.02.13

-

次の記事

e-invoice 2023.10.11