From October 2023, the invoice system for consumption tax will be introduced in Japan. 1.Registration as a ‘Qualified Invoice System’ for existing taxable enterprises (obtaining a VAT number)In order to deduct Input VAT, you have to register as a ‘Qualified Invoice System’; the deadline is the end of 2023/3. Non-resident Japanese individual enterprises and corporations wishing to deduct Input VAT must register. If a non-taxable enterprise registers, it can deduct Input VAT but must file a consumption tax return. Contact ⇒

- 2022.06.15

- customs, customs tariff schedule, Global Trade and Customs, International rules, international tax, Letter of Credit, Risk taking, tariff code, Tax planning, trade & commerce, vat

The Foreign Exchange and Foreign Trade Act controls exports of arms and military-usable goods and technology to prevent them from passing to states, terrorists, or other parties that may threaten the security of Japan or the international community (security trade control). Violations of these export laws and regulations are very severely penalized as unauthorized exports. It is very severe, and in some cases, you may even be sent to prosecution. We will help you establish a right legal system for determining the applicability of your products, screening demanders, and requiring export licenses.This system will prevent you from being subject to post-export inspections by the customs authorities or pointed out by the Ministry of Economy, Trade, and Industry (METI).Our certified security trade control expert with technical backgrounds and experts in The Foreign Exchange and Foreign Trade Act and the Customs Act provide comprehensive backup. Click here to contact us ⇒.

We interviewed Mr. Shibata, Head partner about the firm and himself. Specialized in international taxation, trade & customs and international business TradeTax International Tax & Accounting Office, with offices in Tokyo and Osaka, have specialized in Trade (trade & customs, Japan/Asia Investment and business). With the Asian economy in the spotlight, we provide tax and business support to foreign companies using Japan, Singapore, Hong Kong China as their Asian hubs. In addition to regular accounting and tax services, we also provide support for companies considering listing on the stock exchanges of Tokyo, Nagoya, Sapporo, and Fukuoka in Japan. TradeTax is a member of the Bansei Securities Group, and our new job is to connect finance and real demand such as international transactions. Reorganization through base transfers within Asia, successful exits, and security trade control compliance linked to Europe and the U.S. are also emerging in new business areas. Extensive business experience and network For business owners who are considering investing in Japan/Asia business Japan/Asia is difficult to understand, with a different language and culture from the West. Expatriates of foreign companies in Japan tell us that they have no idea about taxes and laws, and they do not know where […]

The site has been renewed.Thank you for your continued support.

For those in Hong Kong/Taiwan, why not buy Japanese real estate to diversify your assets?The center of Japan’s major cities, even with used properties the value will not decrease over time, and it will sell quickly. Also, if you are renting it, you can take depreciation on it.After its useful life is over, it’s the same as getting real estate for free. We can help you set up, lease, operate and exit with the asset management company.Schemes that do not pay consumption tax are also possible.And the best point is that you can get a management visa, so you can reside in Japan at any time. Please contact us ⇒ Clikc

HS code advantageous change based on customs law theory.Operating profit increase by the change of customs duty / import VAT /consumption tax. ⇒ We will support a workable plan Please contact us. ⇒ Click

An international servicer company in Japan (hereinafter called “ISC”) is rendering service for its foreign parent company. In the Consumption Tax Law of Japan, it is regarded that ISC is exporting service. Accordingly, the full amount of 10% consumption tax (the tax rate is as of June 30,2020 and is expected to go up more in the future) is refunded to ISC at the end of the fiscal year, under the procedure and filing of international tax attorney and accountant. Based on the interpretation as being a service version of export tax exemption. It brings about a result that is identical to favorable turn of the operating profit ratio by 10%. If you would like to know more about the content,Please contact us. ⇒Click

ITR (International Tax Review)an UK magazine, is introducing our firm. If you would like to know more about the content,Please contact us. ⇒Click

- 2020.07.20

- catch-all regulation, customs, epa, free trade, fta, global trade, IBFD, returned goods, rules of origin, tariff, tariff code, tpp11, vat

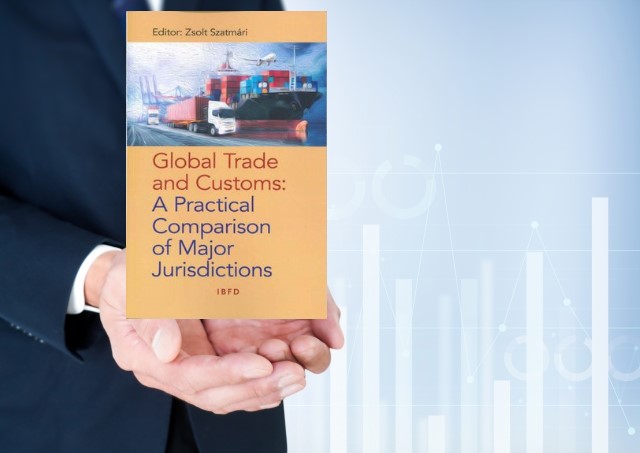

Shibata wrote in the book “GLOBAL TRADE AND CUSTOMS” (published by IBFD).You’ll find information about trade and customs around the world. The contents of is as follows.Chapter 7 Japan Introduction7.1. Classification of goods 7.1.1. Introduction7.2. Rules of origin 7.2.1. Relevance of rules of origin 7.2.2. Free trade agreements 7.2.3. Wholly obtained goods 7.2.4. Last substantial transformation 7.2.4.1. Value-added method 7.2.4.2. Change in tariff classification 7.2.4.3. Manufacturing or processing operation 7.2.4.4. Insufficient working or processing/Non-qualifying operations/Minimal operations 7.2.4.5. Cumulation 7.2.5. Practical aspects and challenges 7.2.6. Proofs of origin 7.2.6.1. Country of origin certification under the Japan-EU FTA 7.2.6.2. Country of origin certification under TPP117.3. Customs value 7.3.1. Transaction value 7.3.1.1. Amounts included in the transaction value 7.3.1.2. Elements to be included and excluded 7.3.2. Alternative valuation methods 7.3.2.1. Identical or similar merchandise 7.3.2.2. Deductive method 7.3.2.3. Computed method 7.3.2.4. Fall-back method 7.3.3. Most typical challenges 7.3.3.1. Related-party pricing 7.3.3.2. Price adjustments 7.3.3.3. Exchange rate 7.3.3.4. Returns and repairs 7.3.3.5. Advance ruling on customs value7.4. Goods […]

TradeTax East Japan in Tokyo : Atsushi Shibata (Mr.) ,CEO wrote in “Global Trade and Customs: A practical Comparison of Major Jurisdictions” (published in July 2020) by IBFD. What is IBFD? It was founded in 1938 to provide information on tax law around the world and to promote the development of tax law. Today, it is the world’s most prestigious international organization of international taxation. IBFD has more than 70 research professionals in over 30 countries and provide high quality and reliable research and information. In the past, Toshihiko Kuroda of Governor of the Bank of Japan and Hiroshi Kaneko, an authority of Japanese tax law (Awarded Medal of Culture in 2018) were also members of the board of trustees and of the advisory council.IBFD official website ⇒Click here If you would like to know more about the content,Please contact us. ⇒Click